Five Dividend Heroes Announce Increases in November — Plus One Special Dividend

ADP, SNA, BDX, ABBV, AFL and AFG continue strong dividend track records

The month of November has already seen five Dividend Heroes reward shareholders with higher payouts, underscoring their consistency and commitment to long-term income growth. In addition, one company declared a special dividend during the same period.

📈 Follow all ongoing updates on Dividend Heroes:

https://www.dividendtrackrecords.com/search/label/Dividend-Heroes

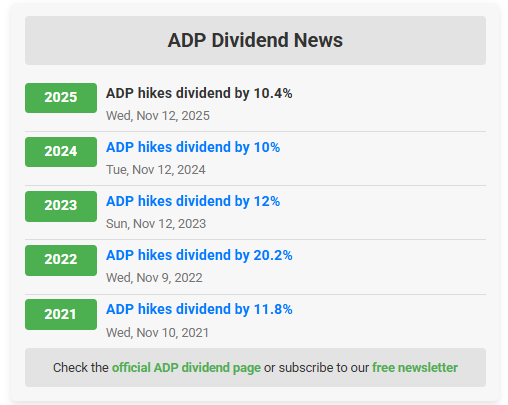

1️⃣ Automatic Data Processing (ADP)

On November 12, 2025, Automatic Data Processing (NASDAQ: ADP) announced a 10.4% dividend increase, lifting its quarterly payout to $1.70 per share.

At a share price of $255, the dividend yields 2.7%, with the ex-dividend date set for December 12, 2025.

ADP, a global leader in human resources and payroll software, has now raised its dividend for 51 consecutive years, reinforcing its elite status as both a Dividend Aristocrat and a Dividend Hero. The company has delivered five straight years of double-digit growth, supported by strong free cash flow and recurring revenues.

Official site →

2️⃣ Aflac (AFL)

On November 11, 2025, Aflac (NYSE: AFL) increased its quarterly dividend by 5.2% to $0.61 per share.

At a share price of $114, the yield stands at 2.0%, with an ex-dividend date of February 18, 2026.

This marks Aflac’s 43rd consecutive annual dividend increase, maintaining its status as a long-standing Dividend Hero. The U.S. supplemental insurer continues to demonstrate steady payout growth, following a strong 16% hike last year.

Official site →

3️⃣ Becton Dickinson (BDX)

On November 6, 2025, Becton Dickinson (NYSE: BDX) announced a 1% increase in its quarterly dividend to $0.95 per share.

At a share price of $182, the stock yields 2.4%, with an ex-dividend date of December 8, 2025.

Becton Dickinson — a global leader in medical technology and diagnostics — has now raised its dividend for 54 consecutive years. Although this year’s hike is the smallest on record for the company, it remains a cornerstone among Dividend Heroes.

Official site →

4️⃣ Snap-on (SNA)

On November 6, 2025, Snap-on (NYSE: SNA) announced a 14% dividend increase, raising its quarterly payout to $2.44 per share.

At a share price of $343, the dividend yields 2.8%, with an ex-dividend date of November 21, 2025.

Snap-on, a global manufacturer of tools and diagnostic equipment, has now raised its dividend for 16 consecutive years. Its five-year compound annual growth rate (CAGR) of 14.7% reflects a disciplined capital allocation policy and consistent earnings performance.

Official site →

5️⃣ AbbVie (ABBV)

On October 31, 2025, AbbVie (NYSE: ABBV) announced a 5.5% dividend increase to $1.73 per share quarterly.

Based on a share price of $218, the dividend yields 2.9%, with the ex-dividend date set for January 16, 2026.

AbbVie, a global biopharmaceutical company known for its immunology and oncology treatments, has now raised its dividend for 54 consecutive years (including predecessor Abbott). The five-year dividend growth rate stands at 5.9%, underscoring consistent shareholder returns.

Official site →

💵 Special Dividend: American Financial Group (AFG)

On November 4, 2025, American Financial Group (NYSE: AFG) declared a $2.00 per share special dividend, payable on November 26, 2025, to shareholders of record on November 17, 2025.

At a share price of $131, the special dividend equals a 1.5% yield, supplementing the company’s regular quarterly payout of $0.88 per share.

AFG, a leading U.S. property and casualty insurer, has distributed more than $54 per share in special dividends since 2021 — in addition to regular dividend increases — reflecting its continued emphasis on returning excess capital to shareholders.

Official site →

💡 Highlight

With five dividend hikes and one special dividend already announced, November reinforces why the Dividend Heroes list remains one of the most reliable indicators of enduring dividend strength.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult a financial advisor before making investment decisions.

Full disclaimer →