Dividend Heroes Update – September 1, 2025

Lam Research, Northrop Grumman, and Nexstar Media Drive +8.8% YTD for Dividend Heroes

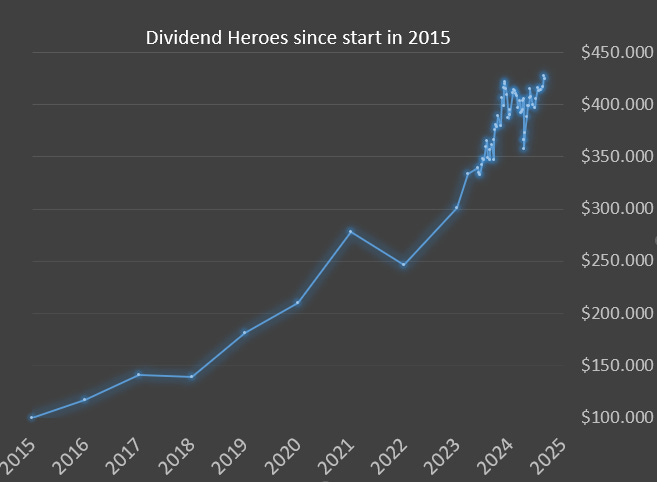

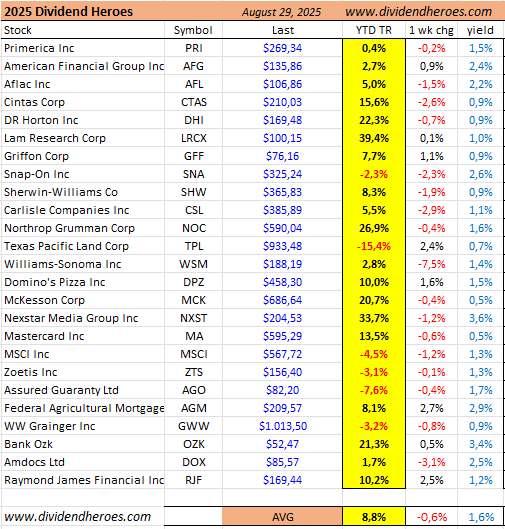

As of September 1, 2025, the 25 Dividend Heroes together show a total return of +8.8% year-to-date, with an average dividend yield of 1.6%.

Key Points – Dividend Heroes (as of September 1, 2025)

Top YTD: Lam Research +39%, Nexstar +34%, Northrop Grumman +27%

Lagging: Texas Pacific Land -15%, Williams-Sonoma -8% last week

High yield: Nexstar 3.6%, Bank OZK 3.4%, AGM 2.9%

The European Heroes are up 8.7% in 2025 and our Japan Heroes are up a whopping 15.5% YTD

The past week brought a mixed picture. The weakest spot came from Williams-Sonoma WSM 0.00%↑ , which lost 7.5% in a single week, while Federal Agricultural Mortgage AGM 0.00%↑ stood out with a 2.7% gain. Texas Pacific Land TPL 0.00%↑ also bounced back by 2.4%, though it remains the biggest laggard of the year with a decline of more than 15%. Domino’s Pizza DPZ 0.00%↑ added 1.6%, extending its solid double-digit advance in 2025.

Among the best performers so far this year are Lam Research LRCX 0.00%↑ , up nearly 40% on the back of demand for semiconductor equipment, and Nexstar Media Group, which has gained more than 30% thanks to its strong broadcasting operations. Northrop Grumman NOC 0.00%↑ has climbed close to 27% in the defense sector, while homebuilder D.R. Horton continues to benefit from resilient U.S. housing demand, gaining over 22%. On the other side of the spectrum, Assured Guaranty is down more than 7% in financial guaranty, while MSCI MSCI 0.00%↑ and industrial distributor Grainger GWW 0.00%↑ are both modestly negative for the year.

Financial names contributed a steady performance, with Primerica PRI 0.00%↑ , American Financial Group AFG 0.00%↑ and Raymond James all posting small weekly gains. Bank OZK OZK 0.00%↑ remains one of the stronger names in the group, up more than 21% this year and offering a dividend yield of 3.4%. Within industrials, Cintas still shows a healthy year-to-date advance despite slipping last week, while Carlisle Companies gave back some ground. In consumer stocks, Williams-Sonoma faced pressure, in contrast to Domino’s Pizza which has been steadily climbing. Healthcare is also split: McKesson MCK 0.00%↑ is firmly positive with a gain of more than 20%, while Zoetis remains slightly in the red for 2025.

Dividend yields across the group vary widely. The average is modest at 1.6%, but some names stand out with higher payouts, such as Nexstar Media at 3.6%, Bank OZK at 3.4%, Federal Agricultural Mortgage at 2.9%, and Snap-On SNA 0.00%↑ at 2.6%.

We also track a 25 stock portfolio for both European and Japanese stocks. The European Dividend Heroes are now up 8.7% on average in 2025, with Japan doing even better with a strong 15.5% Total Return in 2025. Even more impressive: The Japan Heroes for 2025 have a 2.9% yield right now, almost double the USA Heroes yield.

We are planning to write about Europe and Japan later on, but we need Pledges from you first, so let us know if you are willing to pay a small $60 to $100 annual fee to get access to 25 of the best dividend stocks from Japan and Europe. Thank you!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.