Dividend Heroes Deliver Double-Digit Returns in 2025 👑

Lam Research leads the pack as steady payout growth supports performance

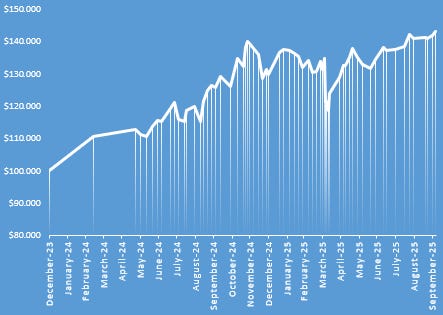

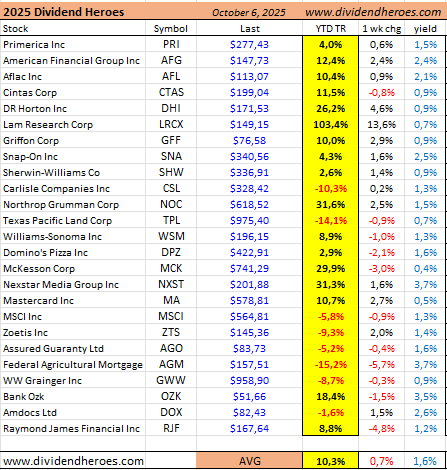

As of early October, the Dividend Heroes portfolio continues to deliver solid results. Year-to-date, the group shows an average total return of 10.3 %, with Lam Research LRCX 0.00%↑ standing out as the clear leader — up more than 100 % so far in 2025. Since the launch of this series in early 2024, the cumulative return has now reached 43.1 %, following a +29.8 % performance in 2024.

Key Points in this article

Dividend Heroes YTD: +10.3%, led by Lam Research.

Since launch (2024): cumulative return 43.1%; Dividend Hike Portfolio +16.1% YTD.

2025 dividend hikes: 17 of 25 holdings, avg +11.6%; five >15%.

New increases: Lam +13%, American Financial +10%, Bank OZK 4x hikes, 27-year streak.

The Dividend Hike Portfolio has done even better this year, advancing 16.1 %, supported by strong earnings and rising payouts across multiple sectors. In contrast, the Dividend Aristocrats have once again lagged, gaining only 5.8 % on average.

This performance gap highlights the different composition of the Heroes — companies often from sectors underrepresented among the Aristocrats, and with shorter dividend track records. That’s why names like Lam Research LRCX 0.00%↑ , KLA KLAC 0.00%↑ (dividend hike portfolio) , and Amphenol APH 0.00%↑ (dividend hike portfolio) are included in our stock selections (either heroes or dividend hike portfolio members): not for decades of history, but for their consistent cash generation and growing distributions in recent years.

Dividend Update

The average dividend yield across the portfolio now stands at 1.6 %, reflecting a balance between growth and income. On average, the Heroes have a 21.5-year track record of consecutive dividend increases — a sign of long-term reliability despite sector diversity.

In 2025, 17 of the 25 holdings have already raised their dividend, with an average increase of 11.6 % year-to-date. Notably, five companies reported hikes of more than 15 %, showing strong operational control without excessive or unsustainable jumps. The latest increases came from Lam Research (+13 %) and American Financial Group AFG 0.00%↑ (+10 %), the latter also rewarding shareholders earlier this year with a special dividend of $2.00.

🔥 For the latest dividend hikes check www.dividendtrackrecords.com 🔥

A notable example of consistency comes from Bank OZK OZK 0.00%↑ , which has already lifted its payout four times in 2025, amounting to a total dividend growth of nearly 10 % this year alone. The regional bank has now extended its streak to 27 consecutive years of dividend increases and is performing solidly in 2025, with a year-to-date total return of 18.4 %. Last week OZK 0.00%↑ did a new 2.3% dividend hike.

Overall, the steady cadence of measured, double-digit increases underscores disciplined capital allocation across the portfolio.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.