Dividend Heroes 2025: Winners, Losers & a Portfolio Under Pressure

Why 2025 Became One of the Most Polarized Years in Dividend Hero History

The 2025 Dividend Heroes landscape has turned into one of the sharpest divides ever seen within the group: a handful of explosive outperformers on one side, and a cluster of heavy laggards dragging the equal-weighted portfolio into one of its weakest years on record.

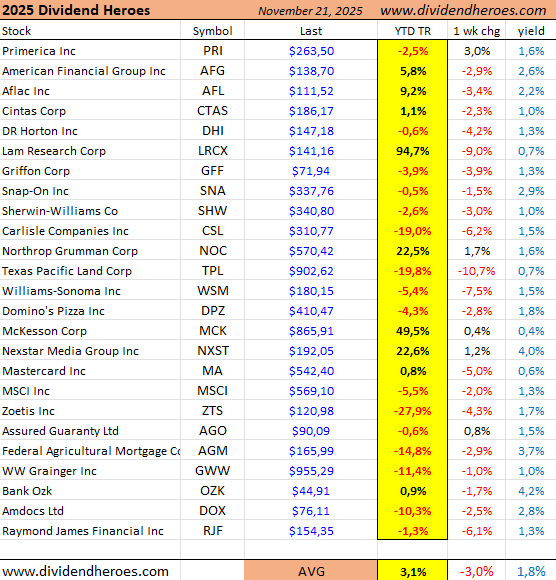

In this article we look at the top and bottom 5 Dividend Heroes in 2025 + we will look at the Dividend Heroes Portfolio (the top-25 ranked Heroes based on stats). Please note that our top-5 gainers and losers in this article includes many stocks that didn’t make it to the top-25 for 2025 (and for that reason are not in the Dividend Heroes Portfolio).

Key Points (2025 Snapshot)

Dividend Heroes portfolio: +3.1% YTD, far behind the DividendHike Portfolio (+13.3%).

Big negative impact from major laggards like Zoetis ZTS 0.00%↑ , Texas Pacific Land TPL 0.00%↑ and Carlisle Companies CLS 0.00%↑ .

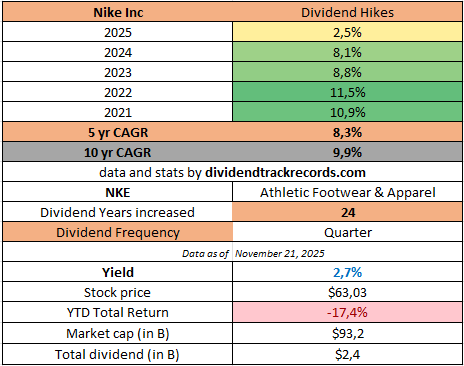

Multiple Heroes exit in 2026 due to weak dividend growth (e.g., Nike’s 2.5% increase).

Europe Heroes weak at +4.7%, Japan Heroes exceptional at +27.7%.

Latest updates on Dividend Heroes are available at dividendtrackrecords.com.

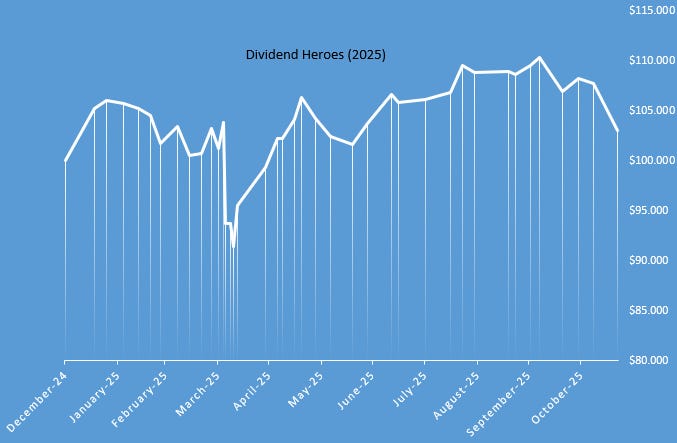

A Difficult Year for the Equal-Weighted Heroes Portfolio

The Dividend Heroes portfolio has delivered just 3.1% YTD in 2025, a very weak outcome when compared to the DividendHike Portfolio, which is up 13.3% YTD. The structural reason is clear: the Heroes list is strictly statistical and always equal-weighted, meaning every stock — winner or loser — has a fixed 4% portfolio weight.

This becomes painful in years with large underperformers. Heavy decliners like Zoetis, TPL and CSL retain their full weighting, dragging the average down far more than in a market-cap or performance-weighted approach. Meanwhile, top performers like LRCX 0.00%↑ contribute only modestly to total return because their weight never rises above the baseline.

In 2024 The Dividend Heroes Portfolio had one of its best years with a 29.8% gain.

By contrast, in the DividendHike Portfolio the weight of winners naturally increases, while the losers shrink over time — allowing the portfolio to compound gains faster. The result is a sizable performance gap in 2025.

Top Dividend Heroes of 2025

Comfort Systems USA FIX 0.00%↑ leads the year with a triple-digit gain

Comfort Systems USA delivered the strongest performance of all Heroes. With a 107.4% year-to-date total return and a dividend yield of 0.3% from its USD 2.40 quarterly distribution, the share price did nearly all the work. The company dominated the 2025 leaderboard with exceptional momentum in building and installation services.

Lam Research LRCX 0.00%↑ posts another outstanding semiconductor year

LRCX 0.00%↑ generated a 94.7% YTD return and maintained a 0.7% dividend yield through its USD 1.04 quarterly payout. Demand across semiconductor equipment markets kept the stock solidly among the best Heroes of 2025.

Amphenol APH 0.00%↑ continues its long-term climb

Amphenol posted an 88.8% YTD return with a 0.8% yield through its USD 1.00 quarterly dividend. Connector demand and consistent capital returns supported another strong showing.

KLA Corporation KLAC 0.00%↑ remains a Hero mainstay

KLAC 0.00%↑ delivered a 76.5% YTD total return while maintaining a 0.7% yield. The USD 7.60 quarterly dividend and sustained semiconductor process-control demand kept it firmly in the top tier.

Broadcom AVGO 0.00%↑ adds another strong year

AVGO 0.00%↑ returned 50.7% YTD with a dividend yield of 0.7% and a USD 2.36 quarterly payout. Although relative performance was milder compared to some peers, it still ranked among the strongest Heroes of 2025.

Bottom Dividend Heroes of 2025

Robert Half RHI 0.00%↑ suffers the deepest decline

RHI 0.00%↑ produced a –62.0% YTD total return despite a high 9.2% dividend yield. Staffing-sector weakness hit the company harder than any other Hero this year.

Owens Corning OC 0.00%↑ hit by construction-material weakness

The stock recorded a –41.2% YTD return with a 2.8% yield and a USD 2.76 quarterly payout, dragged down by sector-wide softness in building materials.

UnitedHealth UNH 0.00%↑ posts rare negative year

Traditionally a stable Hero, UNH 0.00%↑ declined –37.3% YTD. The company continued paying a USD 8.84 quarterly dividend for a 2.8% yield.

Accenture ACN 0.00%↑ pressured by IT spending slowdown

ACN 0.00%↑ ended the year at –30.1% YTD. Its USD 6.52 quarterly dividend, yielding 2.7%, provided little offset to weakening consulting demand.

Watsco WSO 0.00%↑ rounds out the laggards

WSO 0.00%↑ posted a –30.0% YTD result while paying a USD 12.00 quarterly dividend for a 3.7% yield. HVAC distribution remained under pressure through 2025.

More Changes Coming: 2026 Dividend Hero Exits

A notable number of Heroes will leave the list in 2026 due to insufficient dividend growth. Nike NKE 0.00%↑ stands out — its 2.5% dividend increase in 2025 is the smallest in its history, placing it below the minimum threshold for multi-year dividend growth criteria.

Several other names are expected to drop off as well, which will reshape the Hero universe heading into next year.

Global Picture: How the Other Hero Groups Performed

Europe Dividend Heroes: another weak year

The European Top 25 Heroes struggled in 2025 with an overall return of 4.7%. Massive declines in

Novo Nordisk (–48%),

Wolters Kluwer (–42%) and

Bunzl (–35%)

kept the group far below global averages.

Japan Dividend Heroes: the standout of 2025

Japan delivered the best Heroes performance worldwide:

27.7% YTD return for the Japan Heroes selection

No stock down more than 10%

Six names with over 70% gains

One company up an extraordinary 99.7% — this name will be highlighted next week on dividendjapan.com.

Conclusion

The dispersion between the strongest and weakest Dividend Heroes in 2025 has rarely been this extreme. Equal-weight mechanics, large underperformers and insufficient dividend growth all contributed to a soft 3.1% return for the full portfolio, while the DividendHike approach — benefiting from rising weights in outperformers — advanced by 13.3%.

A reshaping of the Hero list is coming in 2026, and global differences remain vast, with Japan dominating, Europe lagging and the U.S. Heroes showing both explosive winners and severe decliners.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult a financial advisor before making investment decisions.

Full disclaimer →