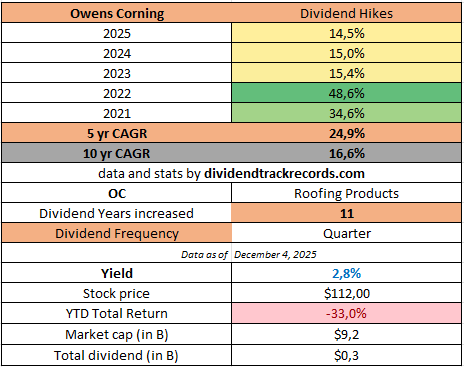

Dividend Hero Owens Corning continues strong track record

A 14.5% dividend hike and 11 consecutive years of increases

On December 4, 2025, Owens Corning OC 0.00%↑ announced a 14.5% dividend increase, lifting its quarterly payout to $0.79 per share. With shares trading at $112, the updated dividend represents a forward yield of roughly 2.8%. Owens Corning has now recorded 11 consecutive years of dividend growth and is recognized as a member of the Dividend Heroes.

Owens Corning is not among the top-25 Dividend Heroes in 2025, and with the stock down 33% year-to-date it ranks as one of the weaker performers despite its strong dividend record; the company continues to repurchase significant amounts of its own shares—more than 4% in 2025 and nearly 30% over the past decade—alongside sustained double-digit dividend growth.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult a financial advisor before making investment decisions.

Full disclaimer →

Really insightful breakdown of OC's dividend consistency. What strikes me most is the tension betewen maintaining that 11-year streak while the stock is down 33% this year. The aggressive buyback program (30% ovr a decade) actually changes the calculus here because it means fewer shares outstanding are absorbing those dividend increases, so the per-share impact compounds faster than it appers. That might explain how they're sustaining double-digit payout growth even during a tough market cycle.

Really compelling analysis of how Owens Corning balances short-term stock pressure with long term capital returns. The contrast between a 33% drawdown and a 14.5% dividend bump illustrates just how much managment is betting on their buyback strategy paying off, especally when they've retired nearly 30% of shares over a decade. If housing starts rebound or commercial consturction picks up, that shrinking share count could amplify gains significantly. It's a fascinating case study in wheather aggressive capital allocation can offset cyclical headwinds in building materials.