Dividend Hero Fortnox AB Going Private

2025 European Dividend Hero Reaches New All-Time Highs, Now Being Taken Private

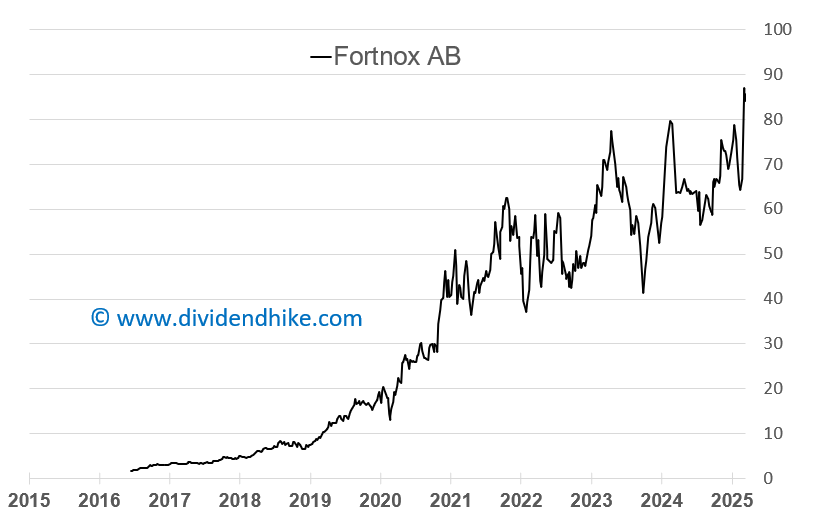

Amidst global market turbulence, Fortnox AB—a pioneer in the Swedish tech and financial software space—has reached new all-time highs, standing as a true outperformer in the sector.

On March 31, 2025, EQT X and First Kraft AB, together forming the "Consortium," announced a recommended public takeover bid for Fortnox AB's shareholders through Omega II AB. The offer proposes a cash price of SEK 90 per share, which cannot be increased.

The Fortnox Board of Directors has unanimously recommended that shareholders accept the offer, supported by a fairness opinion from Ernst & Young AB, confirming the financial fairness of the bid. The offered price represents a premium of approximately 38% over the closing price of SEK 65.1 on March 28, 2025, 37% over the volume-weighted average price of SEK 65.50 in the month leading up to the announcement, and 40% over the volume-weighted average price of SEK 64.30 over the last year.

This 2025 European Dividend Hero is not only known for its innovation but also its incredible dividend growth.

In 2024, Fortnox raised its dividend by an astonishing 66.7%, and this year, the dividend grew again by 25%. This consistent, aggressive growth has earned Fortnox a spot in the coveted Dividend Heroes selection—and as we can see now, it’s paying off, with the stock price hitting a record high ahead of its acquisition.

What’s even more remarkable is that Fortnox has increased its dividend every year for the past ten years, often with double-digit growth—a rare achievement for a European tech/software company. The valuation of Fortnox has always been high, with a forward P/E of nearly 60 for 2025, but this is matched by outstanding financials. The company has delivered a return on invested capital (ROIC) of over 40% in recent years, and this year, analysts are expecting a ROIC above 50%. Add to that an EBIT margin of over 45%, and it’s clear why Fortnox stands at an all-time high—it's no surprise that it’s now being taken private.

Here’s a quick look at the stats for Fortnox AB as of April 11, 2025:

Stock price: Up 18.8% at SEK 85.66

2024 revenue: Increased by 24.5%, reaching a record SEK 2.045 billion

2025 expected growth: Over 21%

Balance sheet: Debt-free, with SEK 635 million in cash at the end of 2024 (and growing year after year)

Dividend growth: 400% in the last 5 years, 1823% over the last 10 years

Dividend yield: A modest 0.3%, but hey, the stock has soared 6500% over the past decade!

Fortnox’s performance has been exceptional, and with its solid cash flow and debt-free status, the dividend increases have been more than justified. Now, the company is being taken off the market—but don’t worry, we still have plenty of exciting dividend growth opportunities in Europe, even from the same sector.

In fact, today we’ll be publishing a new Focus Stock on DividendHike.com, so stay tuned to discover the next big dividend growth star!

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult with a financial advisor before making any investment decisions.