Dividend Heroes Update: 2025 Closes with 9.7% Gain

Lam Research leads with a 143 % gain; Average dividend hike of 11.2% in 2025

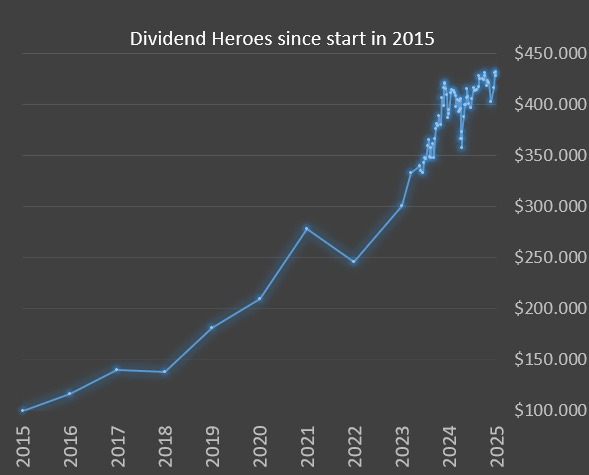

The Dividend Heroes portfolio closed 2025 with a total return of 9.7%, following an exceptionally strong 29.8% gain in 2024. With these results included, the cumulative total return since the portfolio’s launch in 2016 now stands at +369.9%, reflecting the long-term compounding effect of consistent dividend growth combined with equity returns.

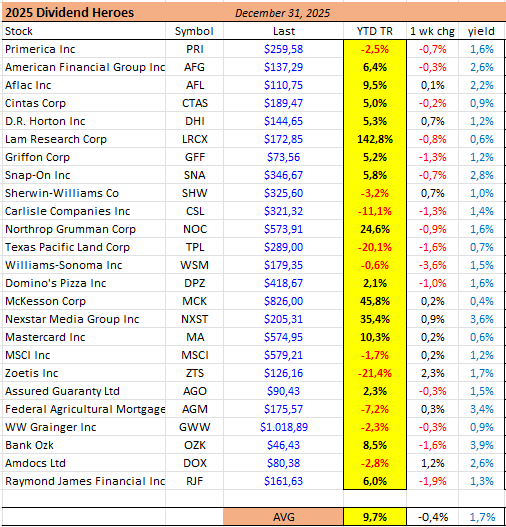

At the end of 2025, the average dividend yield across the portfolio was 1.7%. Dividend growth remained a central characteristic of the Heroes universe, with the average dividend increase announced during the year reaching 11.2%.

Key Points (2025)

Dividend Heroes total return: +9.7%

Prior year (2024): +29.8%

Total return since 2016: +369.9%

Average yield at year-end: 1.7%

Average dividend increase in 2025: 11.2%

Performance Dispersion Within the Portfolio

Performance dispersion remained notable in 2025, with outcomes ranging from strong double-digit gains to meaningful declines. The strongest contributor for the year was $LRCX, which delivered a 142.8% total return, making it the largest individual winner in the Dividend Heroes portfolio during 2025. The company also announced a 13.0% dividend increase, extending its dividend growth streak to 11 consecutive years.

Several other holdings posted solid positive results. $MCK recorded a 45.8% total return alongside a 15.5% dividend increase, while $NXST advanced 35.4% with a 10.1% dividend hike and a year-end yield of 3.6%. $NOC rose 24.6% in 2025 and increased its dividend by 12.1%, extending its dividend growth streak to 22 years. $MA also finished the year higher, posting a 10.3% total return and a 14.5% dividend increase.

Moderate positive returns were observed across a broad group of Heroes. $AFG, $AFL, $CTAS, $DHI, $GFF, $SNA, $DPZ, $AGO, $OZK, and $RJF all ended 2025 with gains ranging from low single digits to the high single digits, while continuing to extend dividend growth streaks between 11 and 43 consecutive years. Dividend increases among this group generally clustered between 8% and 16%.

Negative Returns Despite Ongoing Dividend Growth

Not all Heroes delivered positive returns in 2025. $TPL declined 20.1% and did not raise its dividend during the year, while $ZTS fell 21.4% despite a 6.0% dividend increase. $CSL posted a –11.1% total return while extending its dividend growth streak to 49 years with a 10.0% increase.

Smaller negative returns were recorded by $PRI, $SHW, $MSCI, $AGM, $GWW, and $DOX, all of which maintained positive dividend growth in 2025, with increases generally in the high single-digit to low double-digit range.

Dividend Growth Remains the Common Thread

Across the full Dividend Heroes portfolio, dividend growth remained broadly distributed in 2025. Dividend increases ranged from 0.0% at the low end to 22.2%, with the majority of companies announcing increases between 10% and 15%. Dividend growth streaks across the portfolio continued to span from just over a decade to more than half a century, reinforcing the long-term focus of the selection methodology.

With 2025 now completed, the Dividend Heroes portfolio enters the next phase with a long-term total return of +369.9% since 2016, reflecting the cumulative impact of sustained dividend growth and multi-year equity performance across market cycles.

Next Update: Dividend Heroes 2026 Selection

The Dividend Heroes selection for 2026 will be published shortly. Preparing the annual update requires the processing and verification of a large volume of dividend and financial data across all eligible companies, which explains the longer-than-usual delay. The full 2026 list will be shared once this data review has been completed.

Disclaimer: The information provided here is for informational purposes only and should not be considered financial advice. Investors should conduct their own research or consult a financial advisor before making investment decisions.

Full disclaimer →